16 Sep, 2022

Update on the Reinstatement of PET’s Shares

On 11 July 2022, Phoslock Environmental Technologies (ASX:PET) announced that it received correspondence from the ASX stating that the Company’s securities will be reinstated to quotation on the ASX subject to certain conditions being met (collectively, Conditions and each a Condition).

On 15 September 2022, the Company received confirmation from ASX that upon the release of this announcement, the Company will have satisfied all of the Conditions set out in the July 11 2022 correspondence resulting in the Company’s securities being reinstated to quotation on the ASX’s official list on Friday 16 September 2022.

Content of announcement

- This announcement includes:

an update on the past fraud and mismanagement issues that have impacted PET, including full disclosure of any known ongoing investigations; and - the pre-reinstatement disclosures required by the ASX.

As mentioned above, the Company has received correspondence from the ASX that, by releasing this announcement, PET will have satisfied all the conditions for its shares to be reinstated to quotation on the ASX.

Update on the past fraud and mismanagement issues

In the webinar/announcement released to the ASX on 16 November 2021 ( November Announcement), the Company provided a lengthy and detailed update as to its responses to the past fraud and mismanagement issues that have impacted the Company. In addition, further updates relating to PET’s operations in China were provided in an announcement

released to the ASX on 27 May 2022 (May Announcement); an announcement released to the ASX on 7 July 2022 (July Announcement) and the most recent webinar/announcement held on August 31, 2022 (August Announcement).

The purposes of these announcements were to:

1. provide a further update regarding the past fraud and mismanagement issues which have impacted the Company, including any developments leading up to each announcement; and

2. supplement that disclosure with information concerning the ongoing risks to the Company that are inherent in those matters

As noted in previous disclosures, the Company’s past fraud and mismanagement issues reflect matters that occurred while the Company was under previous management, with the management concerned having now exited the business, and these issues were uncovered by current management shortly after joining the Company in 2020.

Regulatory

As indicated in the November Announcement, the Company self-reported the suspected fraud, foreign bribery and mismanagement issues identified by current management and entered into an Investigation Cooperation Agreement (ICA) with the Australian Federal Police (AFP) which requires the Company to engage cooperatively with the AFP.

The Company’s engagement with the AFP is ongoing. In accordance with the ICA between AFP and the Company, the Company has/is committed to providing proactive and fulsome cooperation to the AFP. Proactive and fulsome cooperation will be an important factor for the Commonwealth Director of Public Prosecutions (CDPP) when deciding whether or not to prosecute the Company or offer it a Deferred Prosecution Agreement should that option become available under Australian Law. Even if the CDPP ultimately decides to prosecute the Company, proactive and fulsome cooperation will also be a significant mitigating factor for sentencing purposes in respect of penalties to be imposed on PET.

The Company has incurred approximately $147,000 in legal costs in connection with the AFP investigation to date in CY2022. It has also incurred approximately $645,000 in other investigation and advisory service fees this calendar year. The Company’s anticipated cost and expense for the remainder of CY2022 is $122,000 in legal fees and $395,000 in investigation and advisory service fees. The agreement deals primarily with offences in the nature of bribery and foreign corruption. There are other offences and proceedings which may be of relevance to the Company’s past actions, some of which are within the purview of the AFP, while others are the domain of other regulatory agencies. The Company intends to keep progressing its management of these matters in the manner reflected in its agreement with the AFP.

The Company has engaged in discussions with the Australian Securities and Investments Commission (ASIC). ASIC has been making enquiries in relation to PET and its financial accounts that have been lodged with ASIC. The AFP has also referred the matter to ASIC for its consideration. There is a risk that the Company will be exposed to judgments, fines and penalties arising from regulatory activity including the AFP’s investigation and ASIC’s inquiries that may have an adverse impact on its financial performance and financial position.

Claims by or against other persons involved in the Company’s affairs

The November Announcement made reference to the BHZQ outstanding receivables, noting that at that time it was the subject of arbitration and court review in China. On 10 January 2022, the Company announced that it had reached a settlement of those Chinese proceedings, which included significant payments on account of the BHZQ receivables. Further, in the July Announcement, the Company confirmed that a court in China ordered the payment of outstanding receivables to PET’s Beijing based subsidiary, Beijing Ecosystime Environmental Science and Technology Co., Ltd, in relation to the XingYun Lake Project.

The November Announcement noted that the Company was “continuing to investigate potential claims against certain individuals. . .with the aim of having the relevant parties held accountable for their actions. . .we intend to take legal action against those responsible for the fraud, mismanagement and gross negligence that we have found and that have resulted in loss and damage to the company. We are in the final stages of examining the viability of those claims. We will update you with further information as soon as we confirm that we have viable claims, and proceedings are commenced. We would like to emphasise that any action we do take will be taken with strong regard to costs – we will not spend money unless it is justified.”

The May Announcement stated the Company’s “intention is to imminently file a legal claim seeking damages from former director Zhigang Zhang.” In addition, it stated the Company’s intention is to “serve a letter of demand on our former CEO and Managing Director Rob Schuitema. Further, “other potential claims are being considered and shareholders will be kept up to date as those matters progress”.

The Company notes that in many circumstances, the initiation of a claim can accelerate or heighten the prospect of counterclaims, or of separate claims relating to similar matters. In this regard, and more generally in relation to the prospect of claims being made against the Company, the Company makes the following statements:

- The Company has not received any third-party claims, or letters of demand relating to these

matters. - As far as the Company is aware, no proceedings have been filed against it in relation to these

matters. - The Company’s perspective on such claims, should they arise, is that they will be defended and

prosecuted with the objective of liability being borne by the actual wrongdoers to the maximum

extent possible, and not by the Company’s shareholders. - Having expended considerable time, effort and cost in investigating these fraud and

mismanagement issues, the Company believes it is well placed to defend any claims that should

arise with the objective stated above (namely that liability is borne by those wrongdoers). - If any claims are made against the Company, or if these risks progress or develop, the Company

will continue to keep shareholders appraised of such developments in a timely manner, and in

accordance with the law and the ASX Listing Rules.

Further, following the fraud and mismanagement issues, the Company has been, and continues to be, exposed to a higher risk of being involved in proceedings, claims and disputes, whether initiated by the Company or persons previously involved with the Company’s affairs. Any litigation, claim or dispute relating to the Company’s past fraud and mismanagement issues may have an adverse impact on the financial performance and financial position of the Company.

After carefully considering (1) inquiries and investigations currently on foot by regulators, with compulsory powers to access documents and information, (2) the significant resources that would be expended by the Company and its key personnel in pursuing these claims, (3) the quantum of potential compensation that could be obtained by the Company, should the claims be successful, the Company has determined to await the outcome of inquiries by regulatory agencies before the filing of

legal claims against the aforementioned parties. The Company will keep shareholders appraised of any developments in this regard.

Pre-Reinstatement Disclosures

PET’s securities were suspended from official quotation on 21 September 2020 due to investigations into the Company’s fraud and mismanagement issues. As noted above, the Company has received correspondence from the ASX that, by releasing this announcement, PET will have satisfied all the conditions for its shares to be reinstated to quotation on the ASX.

The Company provides the following confirmations to satisfy the Conditions for reinstatement of its securities to official quotation on the ASX.

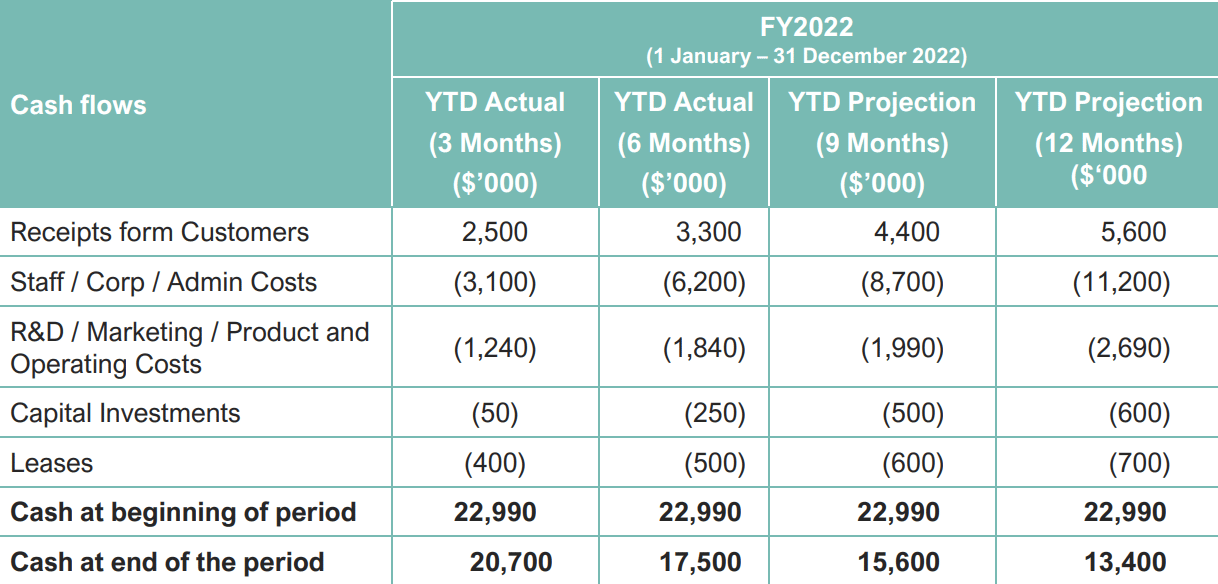

Timeframe for investment of funds to comply with Listing Rule 12.3

The Company proposes to invest and use its funds in accordance with the table set out below in order to comply with Listing Rule 12.3.

Shareholder information

The following shareholder information is contained in Schedule A of this announcement:

Part I of Schedule A: The Company’s 20 largest holders of each class of securities to be quoted, including the number and percentage of each class of securities held by those holders.

Part II of Schedule A: The Company’s distribution schedule of the numbers of holders in each class of security to be quoted.

The Company’s capital structure at the time of reinstatement

The Company’s capital structure at the time of reinstatement will be as follows:

![]()

Working capital statement similar to that required by Listing Rule 1.3.3

The directors consider that, based on the use of funds set out in this disclosure and the reviewed balance sheet submitted as part of the June 30 2022 Appendix 4D, the Company will have sufficient working capital (of at least $1.5 million) to meet its working capital requirements and carry out its activities following the reinstatement of its securities to quotation.

Confirmation that the Company is in compliance with the Listing Rules (including Listing Rule 3.1)

The Company confirms that, Matthew Parker, the CFO and Company Secretary of PET, is the person responsible for communication with the ASX. The Company confirms that it is in compliance with the Listing Rules and, in particular, with Listing Rule 3.1